No, the AHCA Doesn't Make Rape a Preexisting Condition

- OurStudio

- May 5, 2017

- 5 min read

Erik McGregor/Sipa USA/Newscom

The latest less-than-truthful meme about Republicans' American Health Care Act (AHCA), passed by the U.S. House on Thursday, is that it makes rape a "preexisting condition" for health-insurance purposes. According to a host of women's publications and an army of outraged tweeters, sexual assault and domestic abuse survivors could soon be forced to disclose their attacks to insurance companies, which could subsequently deny them health-insurance coverage because of it.

None of this is true. Like, not even a little bit. And the fact it's not just being shared by shady social-media activists and their unwitting dupes but by ostensibly-legitimate media outlets is another sad indictment of press standards these days.

Nothing in the new Republican health care bill specifically addresses sexual assault or domestic violence whatsoever. What it does say is that states can apply for waivers that will allow insurance companies, under certain limited circumstances, to charge higher premiums to people based on their personal medical histories—that's it. (States that are granted the waivers must also set up special high-risk insurance pools to try and help defray costs for these people.) Under Obamacare, no such price variances based on preexisting conditions are permitted.

Historically, conditions that could trigger higher premiums or coverage denials have been mostly chronic diseases and syndromes. Some insurance plans also included pregnancy as a preexisting condition, which—contra the current pop narrative—did not mean that any woman who was or had been pregnant would be denied insurance coverage altogether, simply that those applying for new health insurance while currently pregnant might not be eligible for immediate maternity/prenatal care. And for a while, in the 1980s, it was apparently not unheard of for health insurance companies to deny coverage to domestic abuse victims.

By 2009, however, all but eight U.S. states had passed laws directly prohibiting the practice, and as of July 2014, all but six states had. Even if Obamacare is replaced by the AHCA tomorrow, insurers in 44 states will still be barred by law from considering domestic and sexual abuse a preexisting condition. (Update: Buzzfeed's Paul McLeod confirmed with the National Association of Insurance Commissioners yesterday that there are now only two states, Idaho and Vermont, that don't explicitly "ban insurers from factoring domestic abuse into premium costs." For more detailed information, see this great analysis from Washington Post Fact Checker Michelle Ye Hee Lee and my longer update at the bottom of this post.)

Doesn't that mean there's a possibility that those other six states could choose to apply for waivers, and then insurance companies within them could perhaps choose to charge higher premiums for abuse victims? Yes. They also could choose to charge higher premiums for prior victims of car accidents and ingrown toenails. It doesn't mean they will.

A Politifact investigation in 2009 could turn up no evidence that such practices were happening in the then-eight states that would allow it. "Just because it's legal in some states for insurance companies to cite domestic violence as a pre-existing condition, it doesn't mean that insurance companies are actually taking advantage of the loophole," it noted.

A spokesperson for American's Health Insurance Plans, the health insurer trade association, told CNN this week that "of course survivors of domestic abuse and rape should be covered," and it wasn't simply a federal law stopping insurers from saying otherwise. Kristine Grow, the organization's senior vice president of communications, said the industry willingly follows the guidance in this area set out by the National Association of Insurance Companies, which advises against coverage discrimination for abuse and assault victims.

So far, the only examples offered as evidence that such discrimination is common have fallen far short. In CNN's story, a woman's insurance application was rejected for unspecified reasons that she believes were related to her history of domestic abuse, though the insurance company didn't actually provide any reason. She was able to get health coverage from another insurer not long after.

In the story getting much more attention, a woman who had been sexually assaulted was prescribed anti-HIV medication as a precaution. When she tried to apply for new insurance coverage not long after, her application was denied because of a company policy against insuring anyone who had been on the HIV medication recently. The insurers did not initially deny her claim because she was a rape victim—they weren't even aware of that information at first, though she says she did later inform them. If anything, the company is guilty of not treating this woman differently based on her history of sexual assault.

If you think it's bad that the company wouldn't insure people who had previously taken medication to prevent HIV, then let's talk about that policy! But let's not pretend that "rape" was the preexisting condition the insurer was worried about in this case. And if it's a bad policy, then why not work to change it for all health-care consumers instead of carving out a rape-victim exception? Do people really want a two-tiered system where rape victims can get sexual infection medication covered (if they're willing to talk about the rape to strangers) but people who have consensual sex can't?

If Democrats and progressives would just stick to actual details of the AHCA, they would still have plenty of material to make Republicans look bad (and the same goes for traffic-thirsty bloggers). But once again, that's not enough for them. In their zeal to portray Donald Trump and the current GOP as worse than Nazis, the actual details of the bill don't matter—and if that terrifies a ton of sexual-assault survivors and terrorizes American women in the process, so be it.

Update | May 6, 11:30 a.m.: Since I posted this, several other media outlets have investigated the rape-as-preexisting-condition claims and come to similar conclusions as mine. Politifact declared the claim "mostly false," and The Washington Post—which yesterday morning published an op-ed yesterday perpetuating the rape claim—ran a Fact Checker column today giving it Four Pinnochios. "The notion that AHCA classifies rape or sexual assault as a preexisting condition, or that survivors would be denied coverage, is false," wrote the Post's Michelle Ye Hee Lee. In addition, "almost all states (at least 45 to 48) have their own laws protecting survivors of domestic violence and sexual abuse."

"It takes several leaps of imagination to assume that survivors of rape and sexual assault will face higher premiums as a result of conditions relating to their abuse," Lee continues.

A person would need to be in the individual or small-group market (most Americans under 65 are on employer-provided plans), in a state that sought waivers, and in one of two to five states that did not prohibit insurance-company discrimination against survivors of sexual abuse. In other words, this claim relies on so many factors — including unknown decisions by a handful of states and insurance companies — that this talking point becomes almost meaningless. We always say at The Fact Checker that the more complicated the topic, the more susceptible it is to spin. Both media coverage and hyperbole among advocates are at fault for creating a misleading representation of the House GOP health bill. We wavered between Three and Four Pinocchios, but the out-of-control rhetoric and the numerous assumptions pushed us to Four Pinocchios.

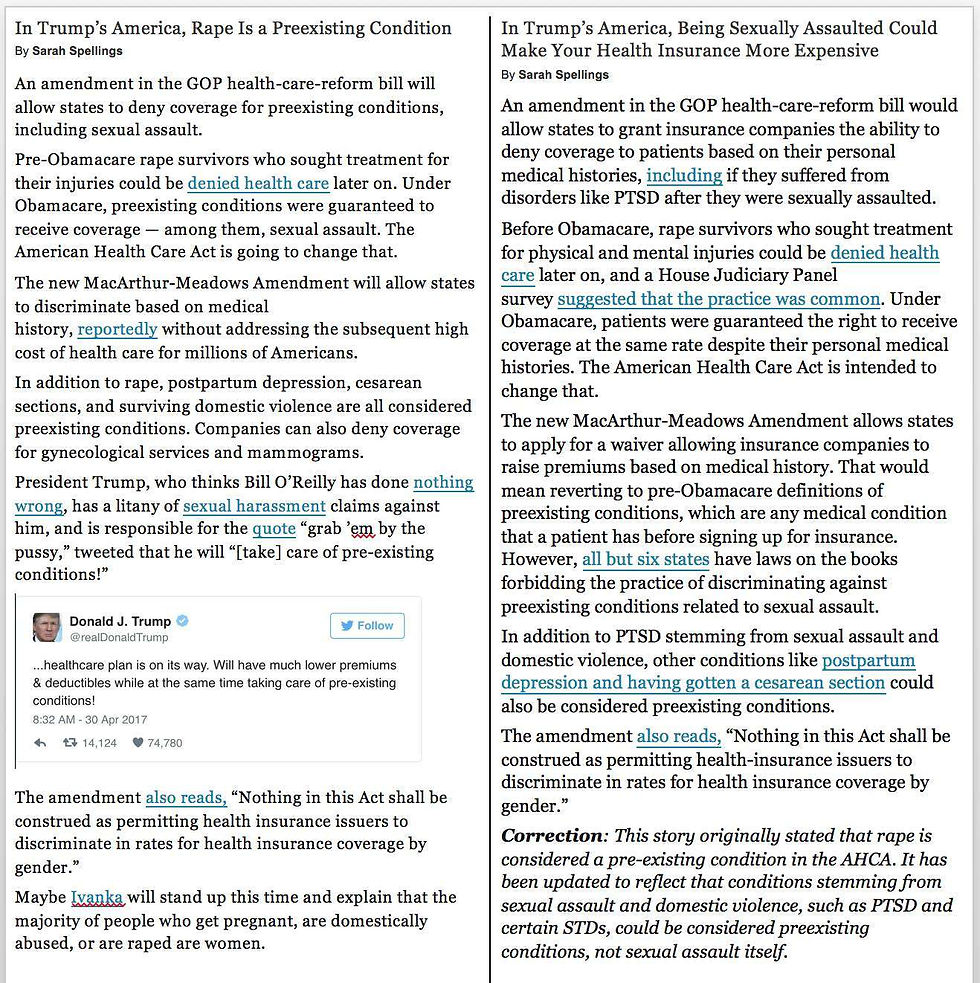

The New York Times admitted that the claims are "overly simplistic" and "need context." Meanwhile New York magazine, one of the original publishers of the AHCA-makes-rape-a-preexisting-condition claim, published a correction on the original piece and edited it significantly, also switching the headline from "In Trump's America, Rape Is a Preexisting Condition" to "In Trump's America, Being Sexually Assaulted Coult Make Your Health Insurance More Expensive" (and even updating the url to reflect the headline change). BizzyBlog pointed this out last night and, using a cached copy of the article, offers a side-by-side comparison:

Allure magazine also walked back bolder headline claims:

As of Saturday afternoon, however, a host media outlets—including Boing Boing, Broadly, and popular millennial news sites Elite Daily, Distractify, and Bustle—were still running with claims that either the AHCA directly lists rape/sexual assault/domestic abuse as conditions that could cost people their insurance or that it permits it in such a way where the practice will become extremely likely.

Comments