Expect Declining Living Standards From Decaying Economic Freedom, Warn Researchers

- OurStudio

- Jun 15, 2015

- 3 min read

Americans need to brace themselves for a declining standard of living—or, at best, very slow improvements funded by drawing off wealth accumulated in the past. That's the warning from two economic researchers who point to the country's slump in measures of economic freedom. Since the ability to buy, sell, use property, and gain wealth without government interference is inextricably linked to economic growth, those sliding rankings—especially when compared to improvements in much of the rest of the world—suggest a long period of economic doldrums in the years to come, so long as the U.S. continues to piss away its legacy of economic freedom.

The warning appears at Investors Business Daily, courtesy of W. Michael Cox and Richard Alm, director and writer-in-residence, respectively, at the William J. O'Neil Center for Global Markets and Freedom at the Southern Methodist University Cox School of Business. Drawing from annual Economic Freedom of the World reports compiled by international researchers and published by Canada's Fraser Institute, Cox and Alm point out that much of the planet is less hobbled each year than the one before by bureaucrats and red tape, but that the U.S. peaked in the late 1990s, slid for over a decade, and has been stuck for several years.

That's bad news for Americans' living standards. It's also, as we'll see below, a lousy omen for those with the fewest means and for liberty in other areas of life.

"High and rising economic freedom spurs the creation of capital in all its forms, planting the seeds for rising living standards," they write. "Where economic freedom falters, capital will be scarce, misused and poorly maintained. Over time, people will become poorer."

Cox and Alm even calculate how much consumption you should expect in the future for several countries, assuming they maintain their current economic freedom rankings. Residents of China are consuming 56.3 percent less than you'd expect given the level of economic freedom. Indians consume 29.3 percent less. People in those countries can probably expect life to get cushier.

But the data predicts a level of consumption 22.2 percent below the current figure for the U.S. Americans can expect a more constrained future. Not so cushy. And the authors say they already see that happening.

Signs are already pointing to an ebbing U.S. capacity to consume. Both mean and median per capita incomes, which grew rapidly in the 1980s and 1990s, have fallen in the past decade. Unless the United States reverses its decline in economic freedom, the best Americans can hope for is middling growth in living standards, and they may not even get that.

If it helps, decades of very high economic freedom give us a capital stock to draw from to cushion the predicted decline.

Not included in the article (which is presented in expanded form in the Center for Global Markets' 2013 annual report) are the wider and equally disturbing ramifications of declining economic freedom. Last year's Economic Freedom of the World report graphically demonstrated just how much better off the poor are in economically free countries than in those with greater government control. Annual per capita income is $11,610 in "most free" countries, abruptly falling off to $3,929 in the second quartile, and declining from there.

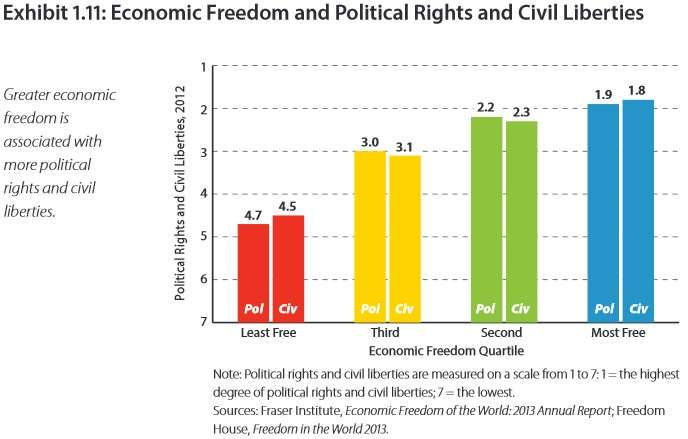

Economic freedom is also closely connected with civil liberties. Relatively free countries tend to respect people's autonomy across the board. Authoritarian governments don't confine their predations to any one area of human life. Freedom is a package deal.

So, if the United States is in for economic stagnation because of decayed economic freedom, we should expect that the poor will be hit hardest. We can also assume that other liberties will also suffer at the hands of intrusive officialdom and proliferating rules.

Comments